New 13-million-person study made possible by BCFG shows behaviorally-informed reminders can reduce loan delinquency

In January, a paper made possible by BCFG and published in the Proceedings of the National Academy of Sciences established that behaviorally-informed emails can reduce student loan delinquencies. The paper, led by BCFG-funded PhD student Rob Kuan (with supervision from BCFG Co-Director Katy Milkman and BCFG Team Scientist Ben Castleman) reports on a 13-million person field experiment conducted in collaboration with a team of economists in the U.S. Department of Education.

What were the key takeaways from the research?

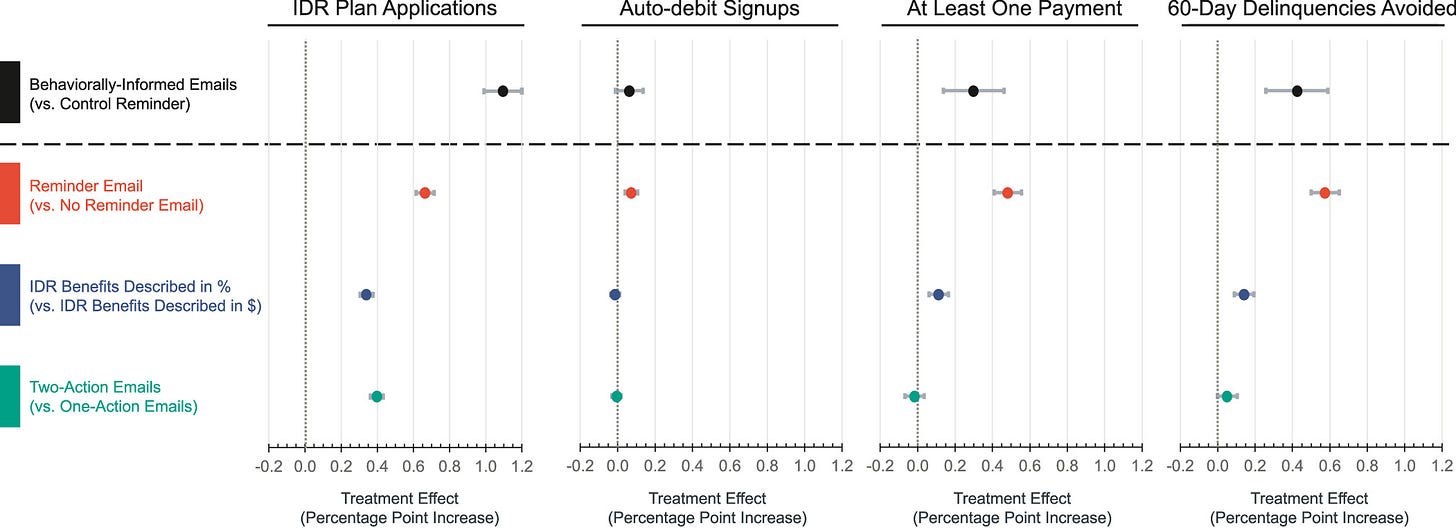

Behaviorally-informed emails recommending action steps to prevent delinquency successfully reduced student loan delinquencies by 0.42 percentage points.

These emails had a greater impact when:

Reminders followed an initial message

Potential savings from recommended action steps were described in percentage terms rather than dollar amounts, and

Multiple messages each recommended two action steps to prevent delinquencies instead of multiple messages suggesting only one step at a time.

Q&A with Team Scientist Wendy De La Rosa

Wendy De La Rosa is an Assistant Professor of Marketing at the Wharton School of the University of Pennsylvania. Her research on financial decision-making has been published in the Journal for Consumer Research and the Proceedings of the National Academy of Sciences, as well as featured in news outlets such as The New York Times, The Wall Street Journal, and CNN.

BCFG: We’re inspired by the innovative experiments you’ve conducted on how to improve peoples’ financial well-being. What motivated you to study this topic?

Wendy: I’ve always been fascinated by the ways people make financial decisions—not just the big ones but the everyday choices that shape their financial well-being over time. Growing up, I saw how financial stress weighed on people around me, not because they were not working hard enough but because the system often made it difficult to get ahead. That stuck with me.

Like many children in immigrant communities, I was deeply involved in my family’s financial decision-making, often serving as the de facto translator. Those experiences made me acutely aware of how financial systems can either empower or constrain people’s ability to thrive.

What excites me about this field is the realization that, just as we have built the financial systems that shape people’s choices, we have the power to change them—if we so choose. My work is about finding those leverage points, the small but meaningful shifts that influence people’s financial well-being.

BCFG: What’s an insight from your work that you wish you could share with more policymakers?

Wendy: One of the biggest insights from my work that I wish more policymakers understood is that financial behavior is not just a function of knowledge or willpower but also a function of the environment in which decisions are made. People don’t wake up in the morning deciding to leave money on the table or to struggle financially. But if claiming a benefit feels overwhelming, if saving requires too many steps, or if a financial incentive feels abstract rather than personally meaningful, then even well-intentioned programs won’t achieve their full impact.

A simple but powerful example is how we frame financial support. My research shows that people are significantly more likely to engage when benefits are described in concrete and relevant ways (like how much food expenses the benefit can cover). This means policymakers should not just focus on increasing benefit amounts or expanding eligibility (that is obvious); they should also consider how benefits are presented and whether they resonate with the realities of the people they’re meant to serve.

Another critical but often overlooked factor is income. Most financial advice focuses on helping people curb their expenses. However, the reality is that for the vast majority of people, buying avocado toast will not meaningfully change their financial situation. But changing how much they earn will. However, we have to go past income levels and focus on the timing of income. Two people earning $50,000 a year can have vastly different financial experiences if they face income volatility or payment frequency. Irregular pay cycles can make it harder to budget, save, and meet financial obligations, yet policymakers rarely design interventions that address these structural challenges.

If we want to improve financial well-being at scale, we need to stop placing the burden entirely on individuals and instead focus on designing systems that make better financial choices the easier, more intuitive option—including policies that help smooth income volatility and ensure people have predictable, timely access to their earnings.

BCFG: Your recent research shows that AI can lead people to make poor financial decisions. Could you explain why this happens?

Wendy: AI will profoundly influence our lives; in many ways, it already has. Most discussions about AI focus on how it can enhance productivity, health, and overall well-being. However, in my research with Chris Bechler, an assistant professor at the University of Notre Dame, we wanted to highlight a different perspective—how the ways in which AI is reshaping the marketplace can decrease financial well-being. We lay this out through our AI-IMPACT Model.

For example, AI is expected to 1) expand credit access, which can lead to overborrowing and a lower “pain of payment” when spending, 2) engender personalized products and prices, 3) enable more frictionless biometric payment methods, which lower the “pain of payment” at checkout, and 4) automate financial tasks, which can decrease people’s ability to manage their finances.

As AI becomes more integrated into financial decision-making, we cannot just focus on its potential benefits—we also need to anticipate and mitigate how it can unintentionally harm consumers’ financial health. Ultimately, AI isn’t inherently bad for financial decision-making—it’s all about how it’s designed and deployed.

BCFG: You’re currently leading work on how to increase low income taxpayers’ likelihood of claiming the tax credits they are owed. Could you share any insights from your work so far?

Wendy: Government benefits like the Earned Income Tax Credit (EITC) have been proven to be highly effective in reducing poverty rates. However, one of the biggest challenges practitioners face is that millions of eligible low-income taxpayers do not claim the EITC.

A key insight from our work is that increasing awareness is not enough— we need to change our communication to match how consumers think about their finances. For example, in work with Abigail Sussman, a professor of Marketing at the University of Chicago, we demonstrated that describing tax credits in terms of their monthly amount (vs. lump sums) increases interest in claiming the tax credit as people can easily map these amounts and incorporate them into their monthly budgets.

Ultimately, our research shows that increasing tax credit take-up is not just about increasing awareness—it is about designing communications that make these benefits feel useful and relevant to the people who need it most.

Many thanks to Wendy De La Rosa for sharing her expertise with BCFG! Learn more about her research here.

Virtual Keynote Event with Harvard Professor Raj Chetty

As part of the Center for Health Incentives & Behavioral Economics (CHIBE) Spring Research Seminar Series on behavioral science and health, BCFG Co-Director Katy Milkman will co-host the second keynote featuring Harvard Economics Professor Raj Chetty. Join us virtually on April 30th from 12-1 pm ET.

Upcoming Events & Past Keynotes

Register now for the final event in CHIBE’s Spring Research Seminar Series on 5/28 featuring Team Scientist and UCLA Professor Hengchen Dai.

Watch a recording of the Fall keynote we co-hosted featuring UC Berkeley Economics Professor Supreet Kaur.

Watch a recording of the first Spring keynote we co-hosted featuring Yale Sociology Professor Nicholas Christakis.

Selected New Journal Articles from BCFG Team Scientists

The Motivating Power of Streaks: Increasing Persistence Is as Easy as 1, 2, 3, co-authored by Katie Mehr, Jackie Silverman, Marissa Sharif, Alixandra Barasch, & Katy Milkman, Organizational Behavior and Human Decision Processes

The Bigger the Problem the Littler: When the Scope of a Problem Makes It Seem Less Dangerous, co-authored by Lauren Eskreis-Winkler, Luiza Peres, & Ayelet Fishbach, Journal of Personality and Social Psychology

Does Communicating Measurable Diversity Goals Attract or Repel Historically Marginalized Job Applicants? Evidence From the Lab and Field, co-authored by Erika Kirgios, Ike Silver, & Edward Chang, Journal of Experimental Psychology

Do Financial Concerns Make Workers Less Productive?, co-authored by Supreet Kaur, Sendhil Mullainathan, Suanna Oh, & Frank Schilbach, The Quarterly Journal of Economics

New Books By Team Scientists

Antiracist by Design: Reimagining Applied Behavioral Science by Crystal C. Hall and Mindy Hernandez

Mindmasters: The Data-Driven Science of Predicting and Changing Human Behavior by Sandra Matz

Negotiation: The Game Has Changed by Max Bazerman

Shift: Managing Your Emotions–So They Don’t Manage You by Ethan Kross

Don’t forget to follow us on social media, where we share new research, job postings, and more: LinkedIn / X / Facebook / Bluesky